RBKC’s budget and Council Tax requirement for 2025 to 2026

The Council will spend £426 million in 2025 to 2026 on a wide range of day-to-day local services such as:

- social care

- the environment

- leisure facilities

- highways

- transport services

- housing needs

- education and skills development

The charts and table below show the full breakdown of the budget (this excludes Housing Benefit payments and dedicated schools grant which are reimbursed by government).

| 2024 to 2025 | 2025 to 2026 | |||

|---|---|---|---|---|

| Net £'000 | Spend £'000 | Income £'000 | Net £'000 | |

| Adult Social Care | 45,230 | 84,270 | (37,976) | 46,294 |

| Public Health | 0 | 27,442 | (27,442) | 0 |

| Children's Services | 49,455 | 71,933 | (23,025 | 48,908 |

| Environment and Neighbourhoods | 18,898 | 102,285 | (83,725) | 18,560 |

| Housing and Social Investment | 20,560 | 78,723 | (56,441) | 22,282 |

| Resources and Customer Delivery | 15,405 | 29,439 | (16,649) | 12,790 |

| Chief Executive | 12,653 | 17,597 | (4,478) | 13,119 |

| Grenfell Recovery | 5,747 | 2,810 | 2,810 | |

| Delivery of Grenfell work | 680 | 1,277 | 1,277 | |

| Total Service Costs | 168,628 | 426,277 | (249,736) | 176,541 |

| Levies | 11,646 | 12,555 | 0 | 12,555 |

| Corporate items (inflation, NI increase, corporate savings, corporate contingency) |

12,050 | 16,699 | 0 | 16,699 |

| Social Care Contingency | 1,805 | 1,831 | 1,831 | |

| Grenfell corporate | 1,180 | 1,098 | 1,098 | |

| Capital, interest, and investment income | (1,588) | 13,453 | (8,084) | 5,368 |

| Transfers to/from reserves | 1,061 | 8,820 | (2,810) | (6,101) |

| Budget requirement | 195,836 | 480,732 | (260,630) | 220,102 |

| Social Care Grant and New Homes Bonus | (18,374) | (21,712) | (21,712) | |

| Retained business rates (includes Revenue Support Grant) | (70,437) | (71,492) | (71,492) | |

| Collection Fund | (2,000) | (2,000) | (2,000) | |

| New and additional grants | (368) | (4,844) | (4,844) | |

| Total external funding | (91,179) | 0 | (111,515) | (111,515) |

| Council Tax requirement | 104,657 | 108,587 | ||

| Council Tax base | 98,878 | 98,606 | ||

| Council Tax per Band D without Garden Square levies | 1,037.58 | 1,079.08 | ||

| Greater London Authority Precept | 471.40 | 490.38 | ||

| Total Band D Council Tax | 1,508.98 | 1,569.46 | ||

| Council Tax per Band D with Garden Square levies | 1,058.45 | 1,101.21 | ||

| Greater London Authority Precept | 471.40 | 490.38 | ||

| Total Band D Council Tax | 1,529.85 | 1,591.59 | ||

Council Tax requirement

The Council Tax requirement after taking into account all income and Government funding is £108.6 million. This is an increase of £4 million from 2025 to 2026 broken down as follows:

| Budget Change | £'000 |

|---|---|

| Social Care pressures and contract inflation | 3,810 |

| Social Care Contingency | 3,727 |

| Provision for (non-social care) contract Inflation | 2,888 |

| Provision for pay inflation 2025 to 2026 | 2,530 |

| Impact of increased employers NI | 4,236 |

| Government funding for employers NI | (1,733) |

| Financing of capital programme | 3,354 |

| Increase in External Funding | (7,136) |

| Increase in fees and charges income | (1,283) |

| Increase in levy charges | 909 |

| Service Growth Pressures | 10,792 |

| Service Savings | (13,182) |

| Corporate Budget Savings | (3,161) |

| Pension Fund saving | (225) |

| Reduction in transfer to reserves | (9,354) |

| Transfer to Budget Stabilisation Reserve | 8,614 |

| Other | (857) |

| Total Increase in Council Tax Requirement | 3,929 |

| Reduction in Council Tax Base | 297 |

| Total Change funded by increase in Council Tax | 4,226 |

What the Council spends on

The diagram ‘How each £100 of Council Tax is spent’, illustrates how each £100 of Council Tax is allocated to different areas of spending for 2025 to 2026. There are seven areas, and each of the areas receives the following amounts out of each £100 spent by the Council:

- Children’s Services receives £27

- Adult Social Care receives £27

- Housing and Social Investment receives £16

- Clean Streets, Parks and Waste Collection receives £10

- Customer and Corporate Services receives £6

- London-wide payments and levies receives £7

- Communities receives £7

How is it paid for?

Council Tax is just one source of the Council’s income. The diagram ‘Sources of funding per £100 of income’ shows sources of funding per £100 of income as follows:

- Government and other grants give the Council £32

- Council Tax gives £17

- Dedicated Schools Grant gives £12

- Business rates and Revenue Support Grant give £11

- Rental income - the Council gets £

- Parking income gives £9

- Fees and charges give £7

- Other income gives £5

Capital expenditure: investment into the borough’s homes, roads, schools, leisure facilities.

The ‘Capital expenditure’ diagram shows how the money for capital spending in the borough is split by themes for 2024/25.

The total sum for capital spending is £85,846m. This is divided as follows:

- £36,814m for the housing sector - new homes

- £2,648m for temporary accommodation

- £9,507m is spent on schools

- £4,186m is spend on other property

- £3,455m is spent on information technology

- £3,871m allocated for highways

- £12,115m is spent on the environment

- £484k for early years

- £3,127m for Parks

- £1,314m for Children’s Social Care

- £7,132m for Adult Social Care

- £1.193m for other capital spending

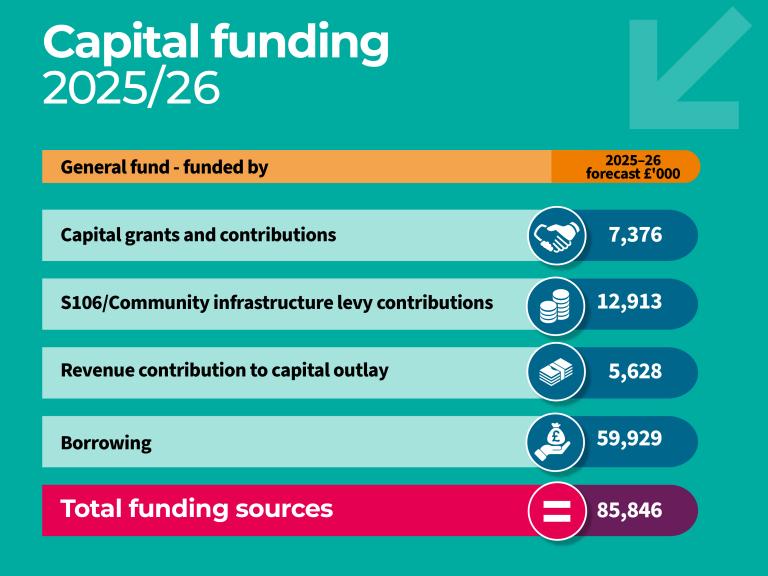

How the Council's capital expenditure will be funded in 2025 to 2026

The ‘Capital funding’ diagram shows the expected funding sources for the Council's general fund capital spending of £85,846m in 2025 to 2026.

Borrowing will provide £59,929m of the funds. Capital grants and contributions will supply £7,376m. Section 106 and Community Infrastructure Levy contributions will make up £12,913m. Revenue contributions to capital outlay will contribute £5,628m.

Looking beyond 2025 to 2026

The Council has set a balanced budget for the 2025 to 2026 financial year, however there are many challenges ahead. The forecasted budget gap is set to reach between £16m over the three years from 2026/27 depending on the future of government grants and funding. Further details on how the Council is addressing these challenges, our pressures and risks over the next few years are set out in the budget report.